The Executive MBA program’s Washington, DC, residency is a unique immersion experience into policy making, regulations, appropriation and budget processes, and legislative action—and how each impacts business.

Washington University’s exclusive relationships with the Brookings Institution, one of the world’s most respected and quoted think tanks, provides a level of access to legislators, administrators, and power brokers that is unique to our DC residency.

So naturally, when the Executive MBA program reintroduced “The Business of Policy” back into the curriculum last year, there was a lot of interest.

“When our alums learned about the new residency, we knew we had to give them a chance to experience this priceless opportunity,” says Meg Shuff, assistant dean of Executive MBA Admissions.

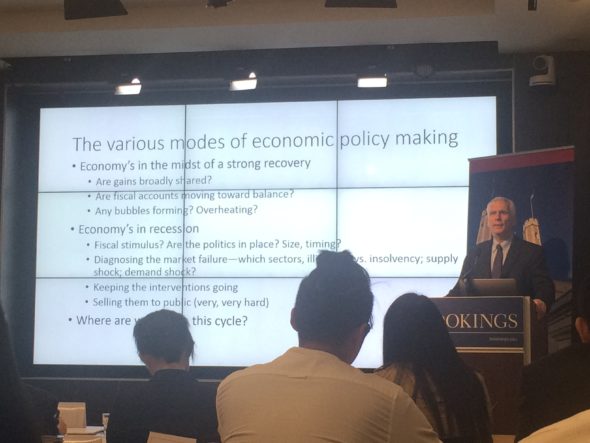

In October, alumni were invited to a mini-residency at Brookings, where they were literally rubbing elbows with key legislative decision makers and some of the leading scholars at Brookings who are working to solve important global issues—essentially, the primary players who keep the engine of our Nation’s capital running. It was a packed two days, with topics ranging from the vital relationship between business, government, and the regulatory process, to combating poverty and the role of media in public policy.

The mock residency sold out quickly, with 24 alumni from eight different cohorts across the country—traveling from St. Louis, Kansas City, Denver, Phoenix, Tampa, Las Vegas, and Atlanta. At the end of two action-packed days, the group had established high-level contacts with influencers in their respective industries, and felt confident in the science of policy entrepreneurship and the art of determining where, when, and how to advance their own interests.

“The Brookings experience was a fantastic way to learn about the intersection of business and policy, which complemented the education I gained at WashU during the EMBA program,” says Executive MBA alum Craig Armstrong, CEO at Loquient. “This residency is a true differentiator that really sets the WashU curriculum apart from the rest.”

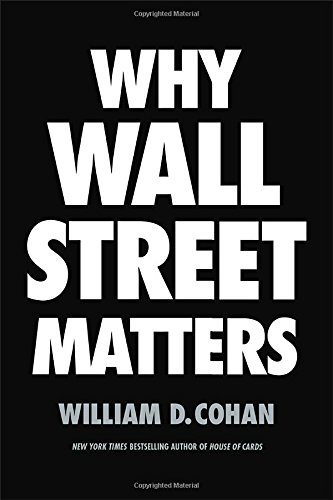

Cohan was a headline speaker at the conference sponsored by the Wells Fargo Advisors Center for Finance and Accounting Research held Aug. 22-23. Cohan’s current career involves writing books about how big finance works behind the headlines. Cohan discussed his latest work, Why Wall Street Matters, with Rich Ryffel, senior lecturer in finance.

Cohan was a headline speaker at the conference sponsored by the Wells Fargo Advisors Center for Finance and Accounting Research held Aug. 22-23. Cohan’s current career involves writing books about how big finance works behind the headlines. Cohan discussed his latest work, Why Wall Street Matters, with Rich Ryffel, senior lecturer in finance.

After the brief introduction, Mr. Dubin gave us an overview about the basic structures of U.S. government and legislative processes to set the stage for the week. He explained the unique roles of the Executive Branch, Senate and House of Representatives, and the complexity of the legislative process.

After the brief introduction, Mr. Dubin gave us an overview about the basic structures of U.S. government and legislative processes to set the stage for the week. He explained the unique roles of the Executive Branch, Senate and House of Representatives, and the complexity of the legislative process.