Boston University’s Amisha Miller examined 2,000 decisions by a real-world venture capital firm weighing the prospects of startups. Wharton Business School’s Valentina Assenova analyzed thousands of episodes of “The Startup Game,” a simulation played globally that casts students as startup funders or founders as they navigate investment decisions.

And the University of Southern California’s Melody Chang contrasted hundreds of cases of conventional equity funding against cases of the relatively new option of equity crowdfunding. At WashU Olin’s invitation, those three scholars and seven others presented research affirming the woeful inequity in startup funding funneled toward women and underrepresented minorities—and exploring the possible causes and likely effects.

The researchers presented their work at the Brookings Institution in Washington, DC, November 10 to an audience of funders and founders who make up the 2022-2023 Olin Brookings Commission, which is working toward a slate of public policy recommendations to address the inequity.

“I appreciate having my experience validated in the work you all are doing,” said Lori Coulter, MBA 1999, a member of the Olin Brookings Commission. She’s the founder and CEO of Summersalt, a tech-enabled women’s apparel company.

Identifying root causes toward finding solutions

Widely reported statistics—reinforced by the stark data shared last week—show that women and underrepresented minorities bring down about 2% of the startup funding provided to founders in the United States. The commission, funded by a grant from The Bellwether Foundation, began its work on this project in September. The seven-member commission, supported by student workers and academics from WashU and Olin, is exploring root causes for the inequity before crafting policy recommendations that could address it. The commission expects to issue its recommendations in April.

As part of that process, the commission organized last week’s academic conference at Brookings. Researchers globally submitted more than 40 papers for consideration. Ultimately, 10 were invited to present their work, sharing early-stage research work focused on the issue.

“This event wasn’t about finding solutions. It’s about examining root causes, and it was very valuable,” said Christine Aylward, founder and managing partner at Magnetic Ventures and a member of the commission. “I have ideas about solutions, and I’m looking forward to getting to those.”

Causes examined in some of the scholars’ research included unconscious bias or other beliefs that lead to different evaluation standards for startups founded by men versus women—or by white individuals versus individuals of color. For example, presenters at the conference shared research showing male founders were asked “promotion” questions—looking for information about startup progress and prospects. Meanwhile, women were asked “prevention” questions—seeking information about staving off problems or avoiding pitfalls.

Unlocking exclusive networks

Another common theme was the power of “homophily”—the idea that “birds of a feather flock together.” Networks tend to develop among people with common interests and backgrounds, which often leads to people outside those networks being excluded from opportunities. Such attitudes, researchers found repeatedly, often lead to the assumption that minorities and women don’t secure as much funding because there just isn’t a robust pipeline of minority and women founders.

“It is lazy to say it is a pipeline issue. It is lazy to say it’s a talent issue,” Nasir Qadree, founder and managing partner of Zeal Capital Partners, told conference attendees. “If you choose to stay where 80% of capital flows or stay within your own social network, then you are going to continue to see the same types of entrepreneurs. That has yielded a bias in terms of this idea that there’s a pipeline issue.”

One research team from Boston University shared early data from a novel research project begun in early 2021—soon after the May 2020 launch of a newly formed venture capital firm that provides pre-seed investments and mentorship for new startups. “We embedded ourselves in the whole process,” said Siobhan O’Mahony, a professor of strategy and innovation at Boston University. The VC firm, established with the expressed purpose of supporting otherwise marginalized communities, allowed researchers to interview participants throughout the process as the firm whittled down 911 funding applicants to 45.

While their work and data analysis is still ongoing, O’Mahony told conference attendees it was already affirming many of the same observations around investor bias.

Leaving money—and ideas—on the table

Their work also provided affirming data for another oft-observed phenomenon affecting the flow of dollars to URMs and women. Projects conceived in these communities often address needs found in these communities—for example, people living in transit-scarce regions or healthcare for targeting minority populations.

Yet while those needs are identified, conventional investment channels historically and systematically dismiss or undervalue them because the incentives to invest are considered too weak.

“We keep dancing around it, but if you want change, it has to come from the funders,” said Andre Perry, a Brookings senior fellow, professor of practice of economics at Olin and commission member.

The work presented left commission members energized and determined, if in some cases also a little stunned.

“What I heard in this room can make a tremendous difference,” said Martin Hunt, CEO of Swanlaab USA Ventures and a commission member. But, he added, the themes raised by the research also smack of Jim Crow economics. “This work repeatedly speaks to the idea that money is being left on the table by not investing in a broader range of founders. We have to start talking about that. If I’m giving money to my retirement fund and you’re not investing in women, that’s not working. You’re costing me money.”

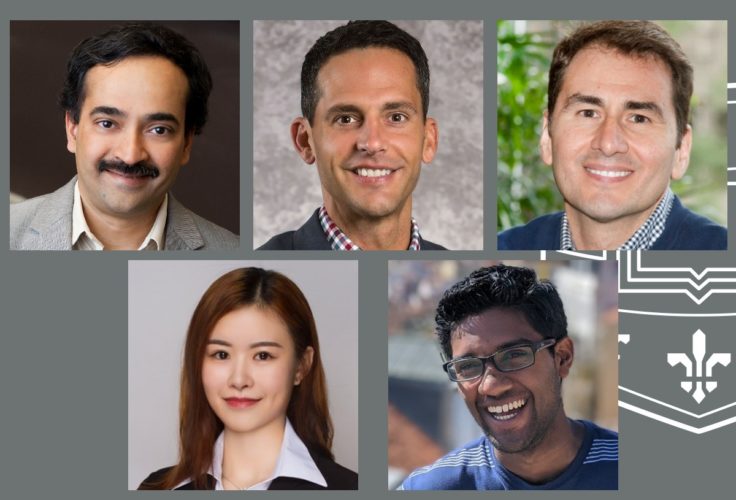

Pictured at top: Emmanuel Yimfor, a researcher from the University of Michigan, presents work on “What explains the venture capital funding gap for black entrepreneurs?” conducted jointly with colleagues from the Federal Reserve Board and Cornell University at the Olin Brookings Commission’s academic conference November 10, 2022.

The foundation promotes the ideals and aspirations of its founders and supporters beyond their lifetime by providing funds to organizations for projects that anticipate the future in the areas of the arts, computer science, education, finance, health care, medicine, and the social sciences, including research in any of these areas.

The foundation promotes the ideals and aspirations of its founders and supporters beyond their lifetime by providing funds to organizations for projects that anticipate the future in the areas of the arts, computer science, education, finance, health care, medicine, and the social sciences, including research in any of these areas.