This is an excerpt of WashU’s summary of the Olin Brookings Commission’s 2023 project. Read more here.

The venture capital (VC) industry has backed some of the most successful American companies and innovation. It is responsible for tremendous growth in pension funds and endowments in recent years and is considered one of the great American inventions, according to Doug Villhard, director of the entrepreneurship program at Olin Business School at Washington University in St. Louis.

It’s well known, however, that the industry does not work well for women, Black and Latinx founders. Despite increased scrutiny on the industry and pledges by VC firms to diversify funding portfolios, funding for women, underrepresented founders has remained persistently low. Just 3% of total VC funds were allocated to these companies last year.

Last fall, the Olin Brookings Commission—a partnership between WashU’s Olin Business School and the Brookings Institution supported by The Bellwether Foundation—assembled a commission of entrepreneurs, venture capitalists and public policy experts to analyze the problem and develop evidence-based solutions to drive more equitable VC funding.

The commission presented their findings and recommendations as outlined in the report, Bridging the Startup Funding Gap for Women, Black and Latinx Entrepreneurs, on April 20 at the Brookings Institution.

Commission member Akeem Shannon, founder/CEO of Flipstik, shared his personal experience in raising funds for his business. “If we want to stay ahead and, more importantly, not fall behind the rest of the global economy, we have to invest in what we have. Let us show you what you’re missing. I think once VCs get a taste of this success, the sky’s the limit.”

Commission members focused their recommendations to address the issue in three categories:

- Increased transparency: When trying to enact change, the first thing you need to do is track where you are today so you can tell whether the strategies are working, Villhard said. Commission members recommended that data leaders like PitchBook and Crunchbase should create options for expanded self-reporting in leading databases and provide a straightforward way for researchers and stakeholders to access and analyze date through a secure platform interface or data sharing agreements. Additionally, investors and mentors should also encourage founders to self-report information in leading databases in respectful ways.

- Government support: Venture capitalists’ one goal is to make the largest possible return for investors, said Morgan DeBaun, AB 2012, a commission member and founder/CEO of Blavity Inc., a tech company for forward-thinking Black millennials. Therefore, the most promising solutions are those that incentivize venture capitalists for making diverse choices, she said.

- Increase public awareness: In the aftermath of George Floyd’s murder and the social unrest that followed, many firms acknowledged there was work to be done to create more equitable funding. We have to hold each other accountable to those commitments as an important first step, Carter said.

Read the entire summary of the Olin Brookings Commission’s work on The Source.

Commission members

- Lori Coulter, co-founder and CEO of Summersalt

- Morgan DeBaun, founder and CEO of Blavity and advisory board member for the Black Economic Alliance

- Martin Hunt, CEO of Swanlaab USA Ventures

- Akeem Shannon, CEO and founder of Flipstik

- Charli Cooksey, founder and CEO of WEPOWER

- Andre Perry, senior fellow at the Brookings Institution

Faculty conveners/PhD students

- Doug Villhard, professor of practice in entrepreneurship, academic director for entrepreneurship

- Daniel Elfenbein, professor of organization and strategy

- Dedric Carter, Olin’s professor of practice in entrepreneurship and WashU’s vice chancellor for innovation and chief commercialization officer

- Gisele Marcus, professor of practice

- Ming zhu Wang, sixth-year Olin PhD student in strategy

- Aditi Vashist, fifth-year PhD student in organizational behavior

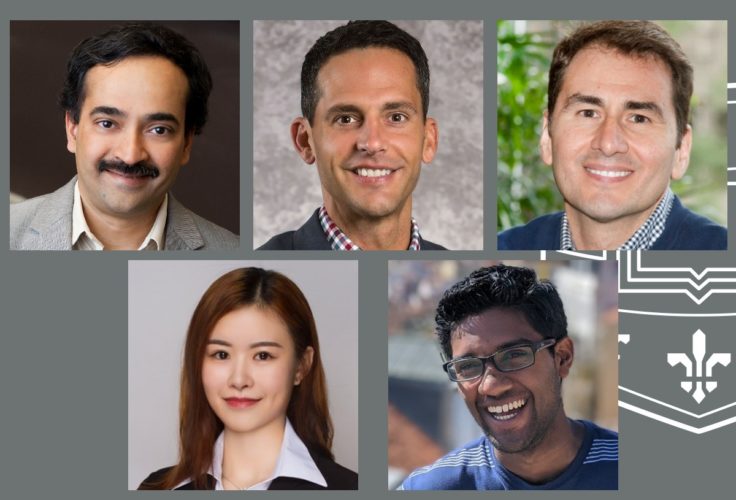

PICTURED ABOVE: Commission members, front row from left: Martin Hunt, Lori Coulter, Akeem Shannon, Charli Cooksey and Andre Perry (not pictured, Morgan DeBaun). Back row, faculty conveners and students, from left: Aditi Vashist, Ming zhu Wang, Doug Villhard, Gisele Marcus and Daniel Elfenbein.