Today’s first lecture was given by Peggy Peterson, a Senior Advisor at Baker Hostetler and former Deputy Chief of Staff for Congressman Michael Oxley. As a versatile member of the government policy group, she has a solid background in policy and communications.

Today’s speech was about the Sarbanes-Oxley Act of 2002 (SOX), which was passed by the U.S. Congress to protect investors from the possibility of fraudulent accounting activities by corporations, therefore improving the accuracy of corporate disclosures. Ms. Peterson first shared some fond memories of Mr. Oxley and then detailed the creation of the Act beginning in 2001. After fully discussing its impact, she answered several questions from us with insightful answers.

Next, we visited the Association of Southeast Asian Nations (ASEAN). Our guest speaker, Marc Mealy, Vice President of Policy on the US-ASEAN Business Council, is very passionate, and had over 20 years of experience in international trading and economics.

Mr. Mealy first gave us a brief introduction to ASEAN and the role they play during the trading process. Next, he discussed the 1997 Asian financial crisis, and what the Asian countries learned from the crisis. He then introduced the Trans-Pacific Partnership (TPP) and Regional Comprehensive Economic Partnership (RCEP). We really enjoyed the site visit and enjoyed enhanced awareness about international trading.

After a trip to the exterior of the White House, we had an opportunity to listen to a speech given by two directors from the Office of the US Trade Representative (USTR): Alexandra Victor and Mitch Gainer. Ms. Victor began with a detailed introduction of USTR. She mentioned the USTR’s mission and expertise, and emphasized its relationship with the trade policy advisory committee system and Congress. After Mr. Gainer spoke, the Q&A session started. The speakers first answered a question about intellectual property, and then pointed out that messaging was also a focus of USTR, in addition to economic gain. Next, they stressed the importance of negotiation when mediating the conflicts among TPP members. Finally, Mr. Gainer shared his experience of working for the Obama campaign.

Next, Kara Miller of the Office of Enforcement within the Consumer Financial Protection Bureau spoke to the group. She gave us an overview of the CFPB, the functions of each department, and multiple tools for consumer protection in order to improve fairness and transparency of the market. Many of our classmates asked challenging questions, and we had a great conversation with Ms. Miller.

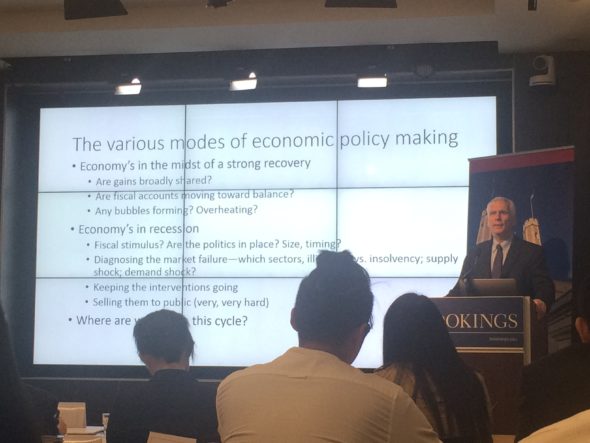

Our last speaker of the day was Jared Bernstein, Senior Fellow at the Center on Budget and Policy Priorities and former Chief Economic Advisor to Vice President Joe Biden. We were grateful to listen to his speech, which was so insightful, as Mr. Bernstein is a passionate and knowledgeable professional. He answered different questions with regard to the different aspects of the economy, and whether it is in the midst of a strong recovery or a recession. He was willing to share his opinions on what the government has gotten wrong and what the government can do to improve. His view on the current political economy gave us a general perception of the overall economy which is fascinating. After a great day today, we look forward to our trip tomorrow!

Guest Bloggers: Ziwen (Jason) Huang, Daiwei Shi, Junyan (Eric) Zhang, Dong An (GMF 2016)

This is a series of blogs chronicling the experiences of 41 Global Master of Finance (GMF)dual degree students during their two week immersion course in New York and Washington, DC. Each blog will be written by a small subset of students during their experience.

To accompany the report, the CCMC also has published an

To accompany the report, the CCMC also has published an