Research and development is the key expertise of Anne Marie Knott, who developed the metric known as the Research Quotient (RQ), the only innovation metric that reliably predicts firm value.

With the new presidential administration announcing its economic-policy intention to invest $300 billion in research and development, there is a key voice offering the caution: Aim for the development end.

That is the counsel of Knott, the Robert and Barbara Frick Professor in the Olin Business School.

“President Biden has his work cut out for him in ensuring ‘a future made in all of America … where the United States wins … the jobs and industries of tomorrow.’

The most important thing he can do in the short-run is dedicate the $300 billion additional R&D to development (D) rather than research (R), she said.

“This level of investment could indeed bear fruit, but not if targeted at research,” Knott said.

(Research is diligent inquiry or examination to seek or revise facts, principles, theories, applications, etc. Development is about growth and directed change. Essentially, one is the creation of new ideas and the other is the application of them.)

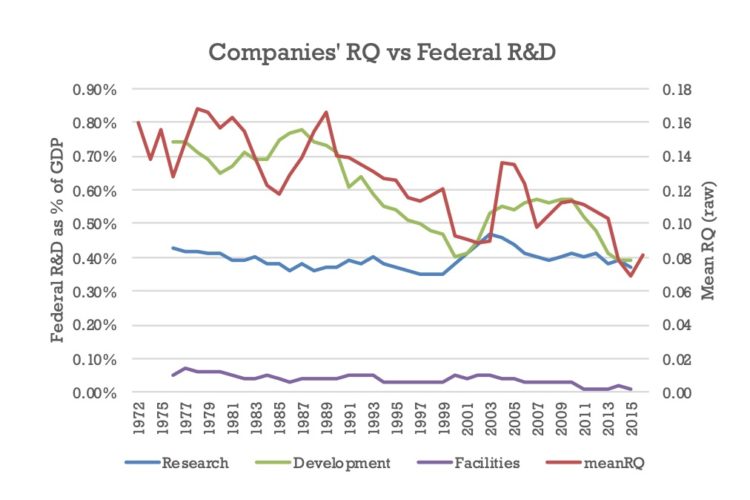

“There has indeed been a dramatic decline in federal R&D support, but the decline is not in research. It is entirely in development.

“In fact, the decline in American R&D productivity tracks the decline in federal development almost perfectly. The decline in federal development is therefore the most likely culprit for the decline in R&D productivity. Thus, investing in research is solving the wrong innovation problem.”