In a concentrated, continuing effort to link Washington University in St. Louis academic research to everyday business practice, the 10th annual Olin Award recognizes an Olin Business School faculty member who joined two University of Pennsylvania professors in crafting a computer model to guide managers who need to forecast behaviors of newly acquired customers.

As is customary, a panel of senior executives review the papers submitted, and these executives ultimately apply some of the findings to their own businesses.

“This rare award rewards relevancy and focuses on the exceptional intellectual capital that applies to real business issues,” said Richard J. Mahoney, former CEO of Monsanto and a Distinguished Executive-in-Residence at Olin where he initiated the $10,000 prize. “I can tell you from decades of corporate experience that academic research all too often is overlooked in the business realm. So here at Olin we strive to connect the innovation and evidence of our faculty with a business community where this science can directly benefit both enterprise and consumers.”

St. Louis-based Edward Jones joined with Jackson Nickerson, the Frahm Family Professor of Organization & Strategy, to help to incorporate Collaborative Structured Inquiry from his 2009 Olin Award-winning paper (see chart, below). Emily Pitts, principal for Inclusion and Diversity, called it an “invaluable experience.”

“Working with Professor Nickerson using this process enabled our firm to make significant progress,” Pitts said. “We were able to identify division by division in our headquarters where we had areas of opportunity to improve on topics such as sourcing diverse talent, recruiting, hiring, developing or just creating a more inclusive environment. Ninety percent of all of our Home Office divisions have completed the process and identified tangible solutions. Some divisions have already begun to see measurable progress, and best practices are beginning to be duplicated across the firm to eventually become standard.”

Mahoney said the 2017 winner exemplifies how quality research can bring solutions to tangible issues affecting business today.

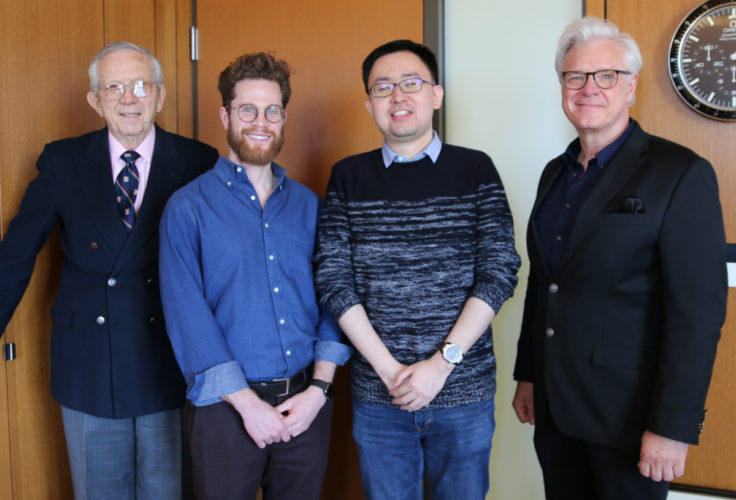

Arun Gopalakrishnan, assistant professor of marketing, is the co-author of “A Cross‐Cohort Changepoint Model for Customer‐Base Analysis,” forthcoming in Marketing Science. Along with two Wharton School professors with whom he conducted doctoral research*, Gopalakrishnan developed two cross‐cohort models — called vector changepoint models — that introduce a new framework for analyzing data which reveals insights into patterns of customer behavior over time. The researchers found that new customers are not simply going to behave like the “average” existing customer. That “average” assumption, according to the researchers, “ignores the potentially changing behavioral patterns” from one set of customers acquired during a certain time period to another.

The new mathematical model takes into account what it calls “regime changes” or past customer behavior changes that were influenced by new firm policy, government regulations, economic factors, competitors’ actions, or unknown drivers of change.

The model was applied to a data set from a public television broadcaster in the U.S. that relies on voluntary donations for part of its operating budget. Comprehensive, 10-year data from more than 50,000 donors were used to estimate the model parameters. That time period included the passing of the Telecommunications Act of 1996, which the model suggests is a type of regime change that may be driving changes in the behavior of donors acquired in or after 1996.

“Our insight is, you have to use the right data for forecasting what the new customers are going to do,” Gopalakrishnan said. “That doesn’t mean there is bad data, but we have found that ‘what’ a customer does is more important than demographic information. And in our data setting, the evidence suggests that new customers are going to behave differently from ‘old’ customers’ behavioral patterns.”

When tested against other models, the Olin Award-winning research model/tool outperformed other benchmarks. It can be applied to any industry that acquires customers who engage in repeat transactions over time. The new model also simplifies the process of mining the data, said Gopalakrishnan: “There is no need to run multiple models to figure out what fits best — our model allows for a large number of possible regime changes, including none, and can determine which model best fits the data in one unified framework.”

* Co-authors Eric T. Bradlow and Peter S. Fader are the co-directors of the Wharton Customer Analytics Initiative and professors at the Wharton School of the University of Pennsylvania.

Previous Winners of the Olin Award

The Olin Business School, celebrating its centennial this year, has benefited from engaged partnerships with business executives and firms that support the school’s research centers and faculty pursuits to improve best practices, innovate and challenge management since 1917. During the decade of the Olin Award competition, nearly 200 papers repres

enting 11 disciplines, from accounting to supply chain management, have been submitted to a panel of leading business executives for review. The Olin faculty includes some of the most prolific and most frequently cited professors in their fields. Mark Taylor, recently appointed dean of Olin Business School, is ranked in the top 1 percent of economists in the world, according to IDEAS/REPEC global rankings of economists, Google Scholar citations, and ISI, Thomson Reuters Citation Analysis.

2016 Radha Gopalan & Todd Milbourn — “Compensation Goals and Firm Performance”

2015 Anne Marie Knott — “Explaining the Broken Link Between R&D and GDP Growth”

2015 Andrew Knight — “Who Defers to Whom and Why? Dual Pathways Linking Demographic Differences and Dyadic Deference to Team Effectiveness”

2014 Lamar Pierce — “Cleaning House: The Impact of Information Technology Monitoring on Employee Theft and Productivity”

2013 Baojun Jiang — “Pricing and Persuasive Advertising in a Differentiated Market”

2012 Tat Chan (Chunhua Wu & Ying Xie) — “Measuring the Lifetime Value of Customers Acquired from Google Search Advertising”

2011 Radha Goplalan, Todd Milbourn & Anjan Thakor — “The Optimal Duration of Executive Compensation: Theory and Evidence”

2010 Judi McClean Parks — “Give and Take: Incentive Framing in Compensation Contracts”

2009 Markus Baer, Kurt Dirks & Jackson Nickerson — “A Theory of Strategic Problem Formulation”

2008 Jackson Nickerson & Todd Zenger — “Envy, Comparison Costs and the Economic Theory of the Firm”

Link to the most recent research from Washington University’s Olin Business School.

Pictured above: Richard J. Mahoney, Arun Gopalakrishnan, and Dean Mark Taylor

News release from WashU’s The Source.