Our morning session on May 26 kicked off with Jason Gould and Richard Choi, two inspiring speakers from Carlton Field Jorden Burt. Carlton Fields is a leading provider of legal and consultation services, mostly to financial institutions, offering solutions to compliance systems and fighting for clients in court. They described the necessity of regulation and the degree of regulation that will protect the industry as well as avoid burdening the business. After various meetings with legislative representatives, we complete our tour in D.C. by hearing from the other side of the aisle. We saw their passion and commitment to speak for regulation objectives and represent their interests. Regulation and legislation together make the financial industry healthy and secure.

Our morning session on May 26 kicked off with Jason Gould and Richard Choi, two inspiring speakers from Carlton Field Jorden Burt. Carlton Fields is a leading provider of legal and consultation services, mostly to financial institutions, offering solutions to compliance systems and fighting for clients in court. They described the necessity of regulation and the degree of regulation that will protect the industry as well as avoid burdening the business. After various meetings with legislative representatives, we complete our tour in D.C. by hearing from the other side of the aisle. We saw their passion and commitment to speak for regulation objectives and represent their interests. Regulation and legislation together make the financial industry healthy and secure.

Next, we departed for Capitol Hill and met with Mr. Ron Klein, a former U.S. Congressman for Florida in the House of Representatives. He served on the full Financial Services Committee, and was also a member of the subcommittee on capital markets, insurance, and government-sponsored enterprises, in addition to the subcommittee on financial institutions and consumer credit. With all this experience, he shared with us his opinions on the mortgage industry, Sarbanes Oxley, the 2007-2009 financial crisis, Fintech, government regulation, student loans, and even his thoughts on the TV series House of Cards.

During the speech, we heard the buzzers from the clock on the wall several times. Mr. Klein explained to us that if there are 5 bells and 5 lights on the left, there is a five-minute vote taking place. If there are 3 bells, a pause, and 5 more bells, there is a 15-minute quorum call immediately after the five-minute recorded vote.

After a short lunch break, we headed to International Monetary Fund (IMF) for a meeting to learn about its history and current role. The speaker began by sharing with us the history of the IMF, and providing insight into the IMF’s roots and its founders. Basically, it is an international central bank which promotes financial stability and cooperation between countries. We have come to appreciate its role as an international corporation. In the Q&A session, one student asked about how to determine if a country’s currency is undervalued or overvalued. The speaker spent a good deal of time answering the question, solving the doubt for students.

After leaving the IMF, we finally got the chance to explore the mysterious and globally renowned Brookings Institute. We then came back to the conference room and learned from Mr. Paul Gumagay, Senior Special Counsel, Office of International Affairs at the Securities and Exchange Commission (SEC).

Mr. Gumagay’s speech was very comprehensive. He started from the very beginning of the SEC and outlined the history and structure of the organization. His presentation was also full of stories from the finance world, which helped us better understand the significance of financial regulations.

In the Q&A session, Mr. Gumagay answered questions concerning regulation of crowdfunding, lending clubs, and other kinds of financial technology firms. Combining this with what we’ve already learned about Fintech and regulation, we now have a more thorough understanding of the concept of Fintech, and how people can better utilize it to make the financial world more efficient and accessible.

Guest Bloggers: Qu (Ashley) Chen, Jialu (Lily) Zhu, Zhiru (Shirley) Lin, Mengchuan (Kitty) Wang (GMF 2016)

This is a series of blogs chronicling the experiences of 41 Global Master of Finance (GMF) dual degree students during their two week immersion course in New York and Washington, DC. Each blog will be written by a small subset of students during their experience.

On Friday, May 27, the last day of our trip in Washington, DC, our first speaker was Jim Wigand, Managing Director at Millstein & Co. He formerly served as the first director of the Office of Complex Financial Institutions at the Federal Deposit Insurance Corporation (FDIC), and as a Senior Advisor to the FDIC Chairman. Although we were all somewhat fatigued after a hectic two weeks, Mr. Wigand’s voice, akin to a news reporter, woke us up. He provided an overview of the FDIC, such as the timeline of its establishment, its primary goals, and the key areas on which it focuses. In addition, he also explained the FDIC’s resolution for banks and thrifts when they are in trouble. After Mr. Wigand’s speech, we all have a better understanding of the relationship between banks and the FDIC.

On Friday, May 27, the last day of our trip in Washington, DC, our first speaker was Jim Wigand, Managing Director at Millstein & Co. He formerly served as the first director of the Office of Complex Financial Institutions at the Federal Deposit Insurance Corporation (FDIC), and as a Senior Advisor to the FDIC Chairman. Although we were all somewhat fatigued after a hectic two weeks, Mr. Wigand’s voice, akin to a news reporter, woke us up. He provided an overview of the FDIC, such as the timeline of its establishment, its primary goals, and the key areas on which it focuses. In addition, he also explained the FDIC’s resolution for banks and thrifts when they are in trouble. After Mr. Wigand’s speech, we all have a better understanding of the relationship between banks and the FDIC. After a short break, we had our second session of the final day: U.S. Financial Regulations from Cecelia Calaby, Senior VP and Executive Director of the American Bankers Association (ABA). Ms. Calaby focused on the area of regulatory policy, securities, trust, and investment at the ABA. Her session was borne from her past work experience, and she offered her thoughts about the US banking industry. First, she shared with us about her background, and how she became the Senior VP of the ABA from serving as a banker at a local bank. She then told us about her experience at a banking simulation program she recently attended. Before taking part in the program, Cecelia thought that monitoring banks’ balance sheets was pretty straight forward. After the program, however, her opinion had changed entirely as a result of the difficult situations she had to face during the training. Additionally, Cecelia gave us her thoughts about what she has seen in the past that still happens in the U.S. banking industry today. In the end, she described some of the biggest challenges that the U.S. has experienced since the Great Recession. She also explained how the ABA supplied information to the public about what was really going on during the subprime financial crisis.

After a short break, we had our second session of the final day: U.S. Financial Regulations from Cecelia Calaby, Senior VP and Executive Director of the American Bankers Association (ABA). Ms. Calaby focused on the area of regulatory policy, securities, trust, and investment at the ABA. Her session was borne from her past work experience, and she offered her thoughts about the US banking industry. First, she shared with us about her background, and how she became the Senior VP of the ABA from serving as a banker at a local bank. She then told us about her experience at a banking simulation program she recently attended. Before taking part in the program, Cecelia thought that monitoring banks’ balance sheets was pretty straight forward. After the program, however, her opinion had changed entirely as a result of the difficult situations she had to face during the training. Additionally, Cecelia gave us her thoughts about what she has seen in the past that still happens in the U.S. banking industry today. In the end, she described some of the biggest challenges that the U.S. has experienced since the Great Recession. She also explained how the ABA supplied information to the public about what was really going on during the subprime financial crisis. Our last speaker of immersion course was Jonathan Weisman, an economic policy journalist from The New York Times. He passionately discussed today’s current events, and generously reviewed public opinions toward Donald Trump, a topic which most speakers avoid. Jonathan’s was asked where he stands when there exists a conflict between the public’s right to know and authorities’ requirement to keep certain information confidential. He told us that it was the New York Times’ tradition to lean on the side of the public’s right to know. Jonathan also shared that the Chinese New York Times website has been blocked by the Chinese government, but that The New York Times keeps updating the website every day, expecting to one day “break the wall.”

Our last speaker of immersion course was Jonathan Weisman, an economic policy journalist from The New York Times. He passionately discussed today’s current events, and generously reviewed public opinions toward Donald Trump, a topic which most speakers avoid. Jonathan’s was asked where he stands when there exists a conflict between the public’s right to know and authorities’ requirement to keep certain information confidential. He told us that it was the New York Times’ tradition to lean on the side of the public’s right to know. Jonathan also shared that the Chinese New York Times website has been blocked by the Chinese government, but that The New York Times keeps updating the website every day, expecting to one day “break the wall.”

Our morning session on May 26 kicked off with Jason Gould and Richard Choi, two inspiring speakers from Carlton Field Jorden Burt. Carlton Fields is a leading provider of legal and consultation services, mostly to financial institutions, offering solutions to compliance systems and fighting for clients in court. They described the necessity of regulation and the degree of regulation that will protect the industry as well as avoid burdening the business. After various meetings with legislative representatives, we complete our tour in D.C. by hearing from the other side of the aisle. We saw their passion and commitment to speak for regulation objectives and represent their interests. Regulation and legislation together make the financial industry healthy and secure.

Our morning session on May 26 kicked off with Jason Gould and Richard Choi, two inspiring speakers from Carlton Field Jorden Burt. Carlton Fields is a leading provider of legal and consultation services, mostly to financial institutions, offering solutions to compliance systems and fighting for clients in court. They described the necessity of regulation and the degree of regulation that will protect the industry as well as avoid burdening the business. After various meetings with legislative representatives, we complete our tour in D.C. by hearing from the other side of the aisle. We saw their passion and commitment to speak for regulation objectives and represent their interests. Regulation and legislation together make the financial industry healthy and secure.

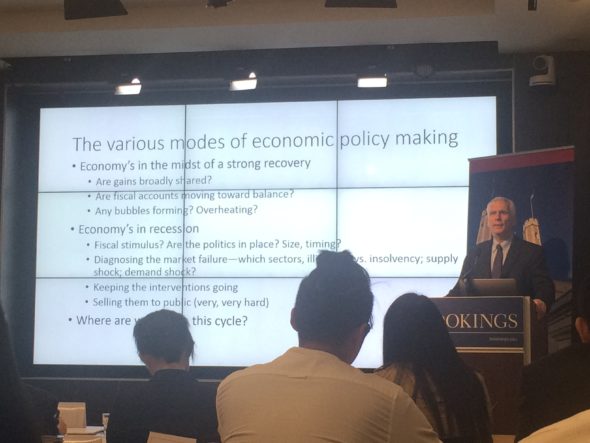

We returned to the Brookings Institution and prepared for a lecture in the afternoon. The first speaker was Amy Shinkman, Director of the Trade Finance Division at the Export-Import Bank of the United States (EX-IM). Interestingly, in the US, EX-IM has a nickname called “Bank of Boeing,” because of its huge engagement in supporting Boeing exports. As an independent government agency, directly reporting to President Obama, EX-IM is primarily responsible for providing loans and guarantees for the purchase of goods from U.S. companies. Amy compared the difference between the commercial banks and EX-IM, and stated that EX-IM commonly does what commercial banks motivated by maximizing profits are unwilling to do. In a way, EX-IM sounds like a hero, busy with helping small businesses and picking the hard nuts to crack. Thus, Amy mentioned that the target of EX-IM is not to earn profit, but to make sure not to lose money. Their job is to “save the world”!

We returned to the Brookings Institution and prepared for a lecture in the afternoon. The first speaker was Amy Shinkman, Director of the Trade Finance Division at the Export-Import Bank of the United States (EX-IM). Interestingly, in the US, EX-IM has a nickname called “Bank of Boeing,” because of its huge engagement in supporting Boeing exports. As an independent government agency, directly reporting to President Obama, EX-IM is primarily responsible for providing loans and guarantees for the purchase of goods from U.S. companies. Amy compared the difference between the commercial banks and EX-IM, and stated that EX-IM commonly does what commercial banks motivated by maximizing profits are unwilling to do. In a way, EX-IM sounds like a hero, busy with helping small businesses and picking the hard nuts to crack. Thus, Amy mentioned that the target of EX-IM is not to earn profit, but to make sure not to lose money. Their job is to “save the world”!

After the brief introduction, Mr. Dubin gave us an overview about the basic structures of U.S. government and legislative processes to set the stage for the week. He explained the unique roles of the Executive Branch, Senate and House of Representatives, and the complexity of the legislative process.

After the brief introduction, Mr. Dubin gave us an overview about the basic structures of U.S. government and legislative processes to set the stage for the week. He explained the unique roles of the Executive Branch, Senate and House of Representatives, and the complexity of the legislative process.