This is the story of how Andrew Stachel and I, along with the help of many friends and mentors (S/O Nina Kravetz), built an organization called Charity Wear.

Charity Wear started via phone call as a school project–and that was our first mistake. “Project.” There is no urgency in calling something a project. Projects are closer to hobbies than they are to real businesses. Projects do not change the world.

But nonetheless, we were 15 and did not even have our driver’s permit. Who cared?

After chatting a bit, we did what every naïve, run-of-the-gun wantrepreneur does: We chose a name. Yep. 3 hours into our phone call we, the two-man team with no revenue, no customers, no anything, had an unlicensed name and a gmail account ready to conduct some business. What that business was going to be was still unknown. Fast forward two weeks: we change our name to Charity Wear.

So what was the plan?

We wanted to efficiently sell shirts to other clubs at our school and donate that money to charitable causes. We believed that the process of in-house design and ordering online was too complex for clubs (initial assumptions). Answering these needs was going to be our core competency (we definitely did not use the word core competency, ever). But we always knew there was more potential to our idea.

The mission: redesign the typical fundraising model by forming a unique product market fit with the way we designed, manufactured, and advertised apparel.

Charity Wear was to be a non-profit club, 100 percent run by high school students.

The reality

Starting Charity Wear was like nothing I had seen in the movies. There were no whiteboards, yoga mats, lean startup canvases, or books about VRIO analysis. We did not even call ourselves social entrepreneurs (God forbid).

We simply started. As Paul Graham would say, we started with the first quantum of utility.

Our first try

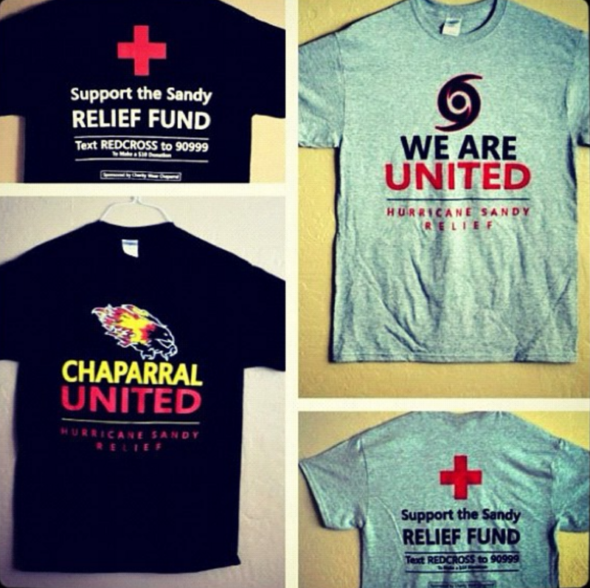

This event would be a product of sheer will and making mistakes. We kicked off this endeavor in aid of the Hurricane Sandy Relief Fund. We were excited—much more excited than our potential customers. Truth is, we flopped, big time.

This is the part most bloggers and entrepreneurs leave out. They talk about going from 0 to $100,000 really quick, but never tell you that the first $100 is 10x harder than the last.

They leave out that getting over the first road bump is what separates sustainable companies and bankruptcies. Most people would never tell a hopeful “entrepreneur” (let alone a 15 year old) this, but I wish someone did. Just in case either of those two types of people are reading this, I will put it in bold: YOU ARE GOING TO SCREW UP & FAIL. 99 PERCENT OF BUSINESSES DO.

What Happened?

We raised about $250 for the Relief Fund selling our t-shirts. Though not an utter failure (after all we did provide some help), it was an embarrassing showing. We could have raised more money collecting donations from parents.

Analyzing our mistakes:

- Overestimated sales: I still have leftover shirts under my bed.

- Ordered wrong sizes: We bought way too many XL shirts.

- Designed inefficiently: As you can see in the picture below, there are two designs. WHY?

- Annoying: Yep. We were annoying (mainly me) and marketed to our consumers poorly.

This brought us to a fork in the road. It forced us to improve. And in doing so, we gained traction.

Do things that don’t scale

This is a concept from Sam Altman’s YCombinator: Doing things that don’t scale. When you are a startup and have a small team, you can do things that big companies cannot. You can afford to individually email reporters and Facebook message to advertise because your time is not on salary. A founder’s metric should not be efficiency, but rather total output. This is your competitive advantage as a startup.

After enough time of doing these things and running small campaigns, we found an idea that we thought could work.

Cue the part of the movie where a flashing light bulb appears and the tempo of the background music picks up.

Play Big

Big. Remember that word. It represented our aspirations and challenges entering our junior year.

We spent the summer planning our biggest event yet: the Play Big Football Game. All of the funds would be donated to a cause much closer to our hearts, the Samantha Stachel Play Big Scholarship Fund at ASU. The concept was to sell the apparel themed for our rivalry football game against Saguaro High School. We integrated the spirit of the cause with the fire of the game in all of our marketing.

This time, we did everything we could, especially things that do not scale.

- We cold-emailed hundreds of potential media outlets

- We were featured in the Arizona Republic, East Valley Tribune, Jewish News, AZ Central, and on television

- We designed and manufactured shirts for the opposition, increasing profits.

- We negotiated the printing price.

- We marketed on the announcements and all over social media.

And it worked: We raised $9,000 in two weeks by selling t-shirts.

What do you do after your first success?

This is a tricky question. No one talks about it, yet it might be even more difficult than finding success in the first place. We analyzed the causes of our initial success and found ways to repeat them. In addition, our campaign was still not perfect. Once again, we ordered too many extra-large t-shirts and failed to sell them out. All of this experience is extremely valuable. I define this process in this quote:

“Trim the fat and iterate over your successes”

For the rest of the year we continued to build on the things we got right. We launched more fundraising campaigns, this time in partnership with other organizations on campus. We raised over $2,000 for our special needs department to fund iPads. We again walked in the Relay For Life, raising the most money in Arizona. But we knew we were not done.

Play Big II

The next big challenge was to repeat the success of our initial Play Big game. It’s easier said than done.

The aim this time was to not only play bigger, but also play better. We focused on execution and used our experience as leverage for making critical assumptions. In addition to iterating on the things that made us successful, we became a bit more professional to cover up our sloppy errors from the first game. We consulted more mentors and took our time in constructing our business plan. We built a larger team to fill our bigger aspirations. All of these things paid off:

- We partnered with a nationwide Twitter community, Smack High. We gained support from students across the country getting excited about our rivalry football game.

- We used professional designing experience to build a shirt that people loved to wear.

- We set up a marketing system in which marketers from all school levels promoted the product. This allowed us to reach more consumers.

- We partnered with a large Arizona radio station to broadcast the tailgate.

- We brought food trucks to the game to increase excitement.

We raised the most money in the history of my high school: $13,000 in 2 weeks.

We helped thousands of people play big.

This event was a success for many of the same reasons our earlier endeavors were deemed to be failures. For better or worse, we were kids who were not afraid of making mistakes. I am confident in saying that without our earlier mistakes, as well as the help from mentors along the way, we would not have been successful in any capacity.

Charity Wear, today:

I know what you are thinking. If Charity Wear was such a big success, where is it today? The truth is that even after all of that, we screwed up. And only now, 6 months removed, is it crystal clear.

We relied too heavily on ourselves and did not plan for the future.

This is a mistake many founders make because they want to do all of the work themselves. But it is also a fatal error. Think of teaching others as an investment.

A great founder is able to inspire others to be as motivated as the founder himself. Always think of the future in the back of your mind.

Today, Charity Wear has become integrated with our high school, still putting on the annual Play Big Event. Since we did not plan ahead, we lost the opportunity to potentially impact thousands more.

I also believe that the idea behind Charity Wear was a great idea and still exists in many forms. Let’s get things clear: selling t-shirts is not revolutionary. But there are good and bad ways to sell t-shirts. Look at successes like teespring for validation. The insight is that we were headed in the right direction.

What you can take from this:

While not all of the lessons I learned while working with Charity Wear are applicable everywhere in business, I am confident I can bring with me many of these skills when attempting to solve future problems. Throughout Charity Wear, I gained experience in design, management, marketing, supply chain, finance, and design. But more than that, I learned how business development really works.

As a summary:

- Do things that don’t scale, as long as you can

- Trim the fat, iterate over your successes

- Start right away

- Do not be afraid to email

- Work with people you know

- Find mentors

- No excuses, ever

I am taking these lessons with me as I look to develop new projects.

Special Thanks to the team: Andrew Stachel, Nina Kravetz, Trent Waller, Rachel Greess, Adam Ichilov, Alexa Ehrenfreund

This post was originally featured on Medium and www.managermint.com, and was republished with permission from the author.