Peter Boumgarden, Koch Center’s director and Olin’s Koch Professor of Practice of Family Enterprise, wrote this for the Olin Blog.

Actionable thought leadership and research into the dynamics of the family enterprise. Forums to come together as family enterprise leaders to shape strategy through a mix of data and opportunities to design. Takeaways from events we stage at the Koch Center for Family Business. These are some of the features in store for readers as we introduce our new monthly newsletter, “The Family Enterprise.”

Today, I want to take a moment to share our plans for the newsletter and, I hope, entice you to subscribe to receive regular updates on what we know—and what we are learning—about the family enterprise. Our newsletter will also include insights from the field as we listen to leaders who are living this reality, snapshots of family organizations in the news, and upcoming ways to engage with the Koch Center, virtually or in person.

As a research center based within one of the world’s preeminent universities, we believe accurate insight and actionable frameworks can add significant value for family enterprise leaders. You will see this vision manifest in our upcoming event, “Data+Design: Striking the Balance Between Continuity and Change,” coming October 29. I hope you will consider joining us.

Unlike a traditional symposium, which is often high on inspiration but lower on concrete takeaways, this session will dynamically help you look inward while simultaneously leaving you with research-informed insights to guide your day-to-day strategic decisions. With this event and others to follow, we aim to generate a cascading impact on private and family enterprises within the region and, by extension, the broader national and international economy.

Starting with some sobering research insights

In our debut newsletter, however, I’d like to share my thoughts on how a university can uniquely add value within this space.

For those of you who don’t know me, you will quickly learn that I seek to be an academic entrepreneur—one whose primary value lies in bridging the academy and the “real world.” But today, I am going to put my academic hat on and start with the raw data.

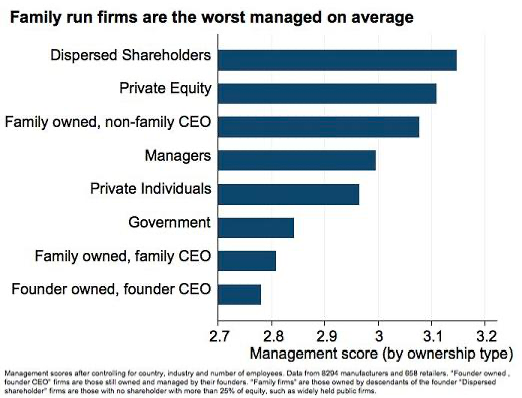

One of the better, albeit somewhat depressing pieces of research done on family organizations comes from Nicholas Bloom, Raffaella Sadun and John Van Reenen. Unlike some of the research that addresses performance through self-reporting (“how professional do you think your firm is?”), these authors trained individuals to objectively assess companies across sectors specific to their general professionalism.

Pulling from a sample of 8,000-plus manufacturing firms and just under 700 retailers around the globe, the researchers wanted to know how family-owned and family-led organizations perform compared to the publically traded firm or groups run by private equity, for example.

As they summarize in a Harvard Business Review piece entitled “Family Firms Need Professional Management,” one of their key insights is that family-owned and family-led organizations sit near the bottom of that list.

What do we do with that?

Now, other than the fact that you might work in or lead an organization like this, why should you care about this data point? As I have discovered since assuming leadership for the Koch Center in early 2021, one compelling reason is that family business is everywhere. While the data is tricky to nail down given different definitions of family ownership, some have suggested that as many as 90% of all businesses in the US are family-controlled (Colli, 2003).

Looking beyond the small business that accounts for some of this finding, consider that founding families also have substantial stakes in about a third of the largest US companies (Shieifer and Vishny, 1986). This means family business includes everything from Walmart and Ford Motor Company to your mom-and-pop operation.

Understanding how to expand the professionalism of these operations is one piece of our goal to drive economic efficiency and extend impact throughout the broader economy.

Now, let’s consider how a research university such as ours might contribute uniquely in this space by returning to the conclusions from Bloom and colleagues. The first bit of good news is that data is not destiny. Just because the category of family-owned firms scored lower on professionalism does not mean that it must be the case moving forward for any particular firm. After all, even within this data, there is a good bit of variance. Put another way, of all family-owned firms in the data, some still scored near the top of the scale and thus on par or above with their public counterparts.

Other patterns within the research provide lessons for families who own organizations. For example, the team found that professionally-managed family-owned firms tended to perform better, on average, than family or founder-led firms.

Another perspective, a brighter picture?

Beyond looking at the professionalism index alone, other research is more optimistic on the ability of family organizations to deliver strong financial performance. Consider the 2016 study, “Fine-tuning family businesses for a new era,” from global consultancy McKinsey & Company:

Overall, family businesses deliver returns on assets that are comparable to or even higher than those of state-owned or widely held companies. But what’s noteworthy about their performance is asset productivity and brand value: their asset turnover, or ratio of revenues to invested capital, is roughly twice that of other companies, and they account for 80 percent of the brand value of the world’s most valuable labels.

Take this all together and you start to realize that how you lead a family organization makes a significant difference in how the organization performs.

In our view, this is where a university can uniquely add value. If the vision of Olin Business School is to “provide world-changing business education, research and impact,” we must participate in this by sharing material that stretches your thinking. We must create opportunities for you to craft strategies that leverage the unique structure by being family-owned.

After all, this is how you create value for owners, employees and the communities you serve. Whether you are a mom-and-pop restaurant or an iconic, global family organization—Ford, Walmart, LVMH, Cargill—for the Koch Center to have a genuine impact on practice, we have to shape you, the practitioner.

Leveraging scholarship to create service

For family organizations to thrive, we believe this is best done not merely by matching the professionalism of public firms or private, equity-controlled counterparts. Instead, we are interested in using scholarship to identify unique forms of performance not easily achievable by publicly traded firms or those with a shorter-term capital mindset. After all, taking the playbook from one type of organization and narrowly applying it to all firms would be a mistake.

Consider, for example, work by Roger Martin from the University of Toronto, writing in HBR, “It’s Time to Replace the Public Corporation.” Here, he explores ways in which private ownership enables a proper focus on the long-term. One might look no further than Warren Buffet to see an investor who realizes the potential power of family culture and legacy and how operating with an extended time horizon might be a source of unique competitive advantage.

In other words, while any episode of HBO’s “Succession” will highlight how a clash between family and business purpose can undermine the value creation of family organizations, we also believe that a creative alignment of these goals might drive a different way of operating in the marketplace. You’ll hear echoes of some of this potential in what Olin alumni and MTM CEO Alaina Macia shares in our September’s “View from the field.”

That is why we are here. This is what you are likely to see from us moving forward. We know a university is not the only player that can add value within this space. This understanding guides the mix of academics and practitioners we intend to bring to your inbox and to our events.

That said, we do think we can be unique in providing some objectivity and rigor when exploring essential questions that deserve actionable insights. Through a mix of research, thought leadership and events that allow you to explore and design strategy in real-time, we hope to aid the development of a sector that drives much of our economy.

To the extent we can assist this development—through models to drive professionalism, methods to think about capital with a longer time horizon, or approaches to balancing family and business purpose—we will consider our work a success.

We look forward to engaging in this ongoing conversation in the months ahead.