On the morning of May 18, our Global Masters of Finance class traveled to Neuberger Berman, one of largest private investment management firms. We were eager to learn. Dan Smith, Bill Arnold, Randy Gross, and Jeff Bolton, a group of highly reputable professionals with years of enriched industry experience, gave us a very informative and inspiring presentation.

To begin, Bill Arnold, CFO of Neuberger Berman, talked about Neuberger’s history

from its inception in 1939, through struggling and spinning off from Lehman Brothers during the Global Financial Crisis. Today, Neuberger has Assets Under Management (AUM) over $250 billion.

Bill also explained the overall investment strategy and philosophy of Neuberger, their unique view of risk, trying to be cautious and long-term, and how they excelled at re-positioning portfolios.

Mr. Gross, from the fixed income department, shared his insights about the impact of negative interest rates and the growing popularity of municipal bonds, while Mr. Smith, an expert in equity, provided his insights regarding recent trends in utilities and other sectors. At the end, Mr. Bolton not only spoke about how to be successful in investing, but also provided advice and guidance about work balance.

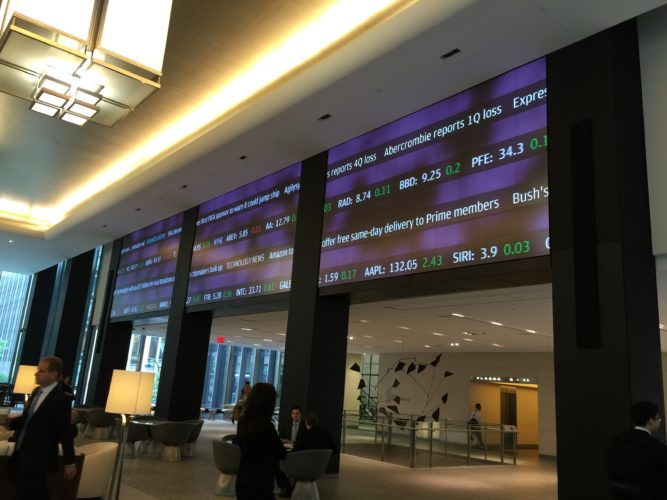

We walked back to the conference room after the tour while looking at amazing architecture along the way.

“How many of you guys are in debt?”

The first afternoon speaker was Steve Wood from Jefferies. He started with an interesting question: “How many of you guys are in debt?” The question helped us understand the debt concept better and think it through more clearly. Through his speech, we learned a lot about public finance and municipal bonds. Specifically, most of us in the masters of finance class were amazed by the fact that there are over 70,000 different municipal bond issuers. We actively participated throughout his lecture, and some of us even continued the discussion about the default of governments like Puerto Rico in his speech. He explained in detail how a government facing a credit crisis could possibly turn things around, such as cutting expenses, increasing revenue, reconstructing their debt, and so on.

Endowment Funds

After learning about bonds, Michael Garvey’s talk kept us engaged after lunch. As a J.P. Morgan Investment Specialist, he spoke briefly about the endowments and foundation groups in an interactive and informative way. He informed us that the interest rate change is shifting the proportion of debt in traditional portfolios to 40%.

After one of our masters of finance classmates raised an insightful question, Mr. Garvey explained that the proportion of cash and domestic equity in asset allocations go down with an increase in the size of endowment funds. So in that case, the size of alternative investments, such as hedge funds and private equity, also increases, since alternative investments have longer time horizons and hence provide a liquidity premium. He also mentioned that during times of stress, the movements of different markets converge. For example, equity of emerging and developed markets become correlated, when they are intended to be diversified. He concluded that no single measure of risk can fully characterize a portfolio.

The day was nicely wrapped up by Mitchell Moss, an Olin grad, BSBA & Master of Finance & Accounting’00, from Lord, Abbett & Co. Mr. Moss spoke with us about his work experience in the finance industry, especially in the power and utilities sectors.

He also gave us some tips about how to get a job in financial institutions and what it would be like in different positions within the industry.

After the presentation, Mr. Moss left about 30 minutes for Q&A, and we raised a lot of interesting questions, such as “What are the fundamental factors that an equity researcher and a credit rater would take into account for a company?” and “What is your daily life like at work when you are in different companies in finance industry, ranging from consulting, credit rating, buy-side, to sell-side companies?” Mitchell answered all of our questions adequately and left us satisfied and motivated.

Guest Bloggers: Kaibo Xue, Zihao (Zach) Gong, Mallika Mital, Lin (Angie) Wu, Xiaoqi (Kay) Wu (GMF 2016)

This is part of a series of blogs chronicling the experiences of 41 Global Master of Finance (GMF) dual degree students during their two week immersion course in New York and Washington, DC. Each blog will be written by a small subset of students during their experience.

t started to play around with the long term interest rate, buying all the financial assets to lower the long term yield. Also, contrary to people’s expectation, the US housing market has not recovered, and neither has the US economy.

t started to play around with the long term interest rate, buying all the financial assets to lower the long term yield. Also, contrary to people’s expectation, the US housing market has not recovered, and neither has the US economy.