The morning of May 28, we walked to one of the world’s biggest names–JP Morgan. Here we met a campus recruiter from the HR department, an asset management associate specializing in alternative investment, and four Wash U graduates who currently work in a variety of asset management divisions. They shared with us their personal experience with JP Morgan and their working routine. After our lunch break we met another speaker, Michael Garvey, from JP Morgan asset management department who gave us some thoughts on endowment investment.

The morning of May 28, we walked to one of the world’s biggest names–JP Morgan. Here we met a campus recruiter from the HR department, an asset management associate specializing in alternative investment, and four Wash U graduates who currently work in a variety of asset management divisions. They shared with us their personal experience with JP Morgan and their working routine. After our lunch break we met another speaker, Michael Garvey, from JP Morgan asset management department who gave us some thoughts on endowment investment.

That afternoon we went to another famous financial service powerhouse, Jefferies. After a brief case study of Jefferies’ acquisition of a St. Louis historical site (Renaissance Grand Hotel), Mr. Stephen Wood gave us a knowledge-packed overview of the municipal bond markets. The lecture covered municipal bonds’ definition, characteristics, relation with the economic environment, performance compared with treasury bonds, relation with the mutual fund flows, its credit features, and the recent trends in state debts from a global perspective. Stephen was very knowledgeable in the municipal bonds area and provided us a lot technical information about this area, with which we were not previously familiar.

The lecture at Jefferies included a case study of the debt of the State of Illinois, especially in Chicago’s municipal bonds, which we also heard about in our visit to Standard & Poor’s the previous day. We gained a basic understanding of how bonds work, specifically municipal bonds’ position in governments’ obligations, and the way that municipal bonds are sold and traded.

We ended our day with Anthony Scaramucci, founder of SkyBridge, a global alternative investment firm that specializes in funds of hedge funds products. The first point he talked about was to build one’s reputation consistently, always doing the right thing legally and morally. Mr. Scaramucci also shared with us his opinions on the global economy. He thinks that our economy is in a post-traumatic stress disorder after the global crisis. Specific to the US economy, he mentioned that when the Fed couldn’t bring down the short term interest rate below zero, i t started to play around with the long term interest rate, buying all the financial assets to lower the long term yield. Also, contrary to people’s expectation, the US housing market has not recovered, and neither has the US economy.

t started to play around with the long term interest rate, buying all the financial assets to lower the long term yield. Also, contrary to people’s expectation, the US housing market has not recovered, and neither has the US economy.

Mr. Scaramucci also spoke about deflation as a phenomenon worse than inflation. First, a dollar of money today will be worth more than a dollar of money tomorrow, which means that people would not spend their money today because they expect prices to be cheaper tomorrow. Second, deflation brings wages down. Firms could let some people go to keep wages affordable, creating unemployment. Third, deflation will make debt go up in real terms.

Guest Bloggers: Jianshi (Dennis) He, Xiaoran (Sharon) Sun, Changchang (Sophie) Wu (GMF 2015)

This is the eighth in a series of 10 blogs chronicling the experiences of 31 Global Master of Finance (GMF) dual degree students during their two week long immersion course in Washington, DC and New York. Each blog will be written by a small subset of students during their experience.

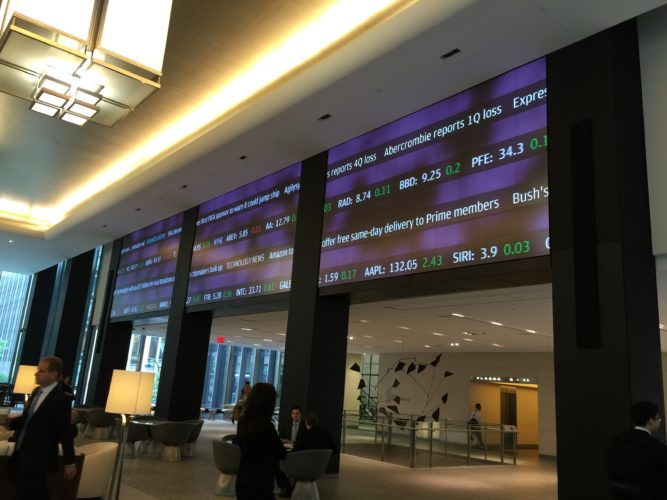

r first stop was the Museum of American Finance. The class was given the opportunity to learn more about the evolution of the financial industry in the U.S. through the centuries. We saw how stock information was transmitted in the late 1800’s via the Edison telegraph machine all the way to the modern Bloomberg terminal.

r first stop was the Museum of American Finance. The class was given the opportunity to learn more about the evolution of the financial industry in the U.S. through the centuries. We saw how stock information was transmitted in the late 1800’s via the Edison telegraph machine all the way to the modern Bloomberg terminal.

In the afternoon, we traveled to Neuberger Berman (NB), a private, employee-owned investment management firm also based in New York. We were honored to spend two hours with Chief Financial Officer William Arnold and a couple of specialists from different departments of the firm. They gave us a brief introduction to NB and how it became an employee-owned firm from a subsidiary of Lehman Brothers. Also, they mentioned the loyalty of the employees, which is a difference-maker compared with other corporations; we were highly impressed. Successively, they shared their opinions on challenges in the industry of mutual funds; talked about their municipal bond portfolios; and the role of active versus passive investment management. We also got some interesting insight on the life of an employee before and after the Lehman collapse, which is not an ordinary story for a student to hear.

In the afternoon, we traveled to Neuberger Berman (NB), a private, employee-owned investment management firm also based in New York. We were honored to spend two hours with Chief Financial Officer William Arnold and a couple of specialists from different departments of the firm. They gave us a brief introduction to NB and how it became an employee-owned firm from a subsidiary of Lehman Brothers. Also, they mentioned the loyalty of the employees, which is a difference-maker compared with other corporations; we were highly impressed. Successively, they shared their opinions on challenges in the industry of mutual funds; talked about their municipal bond portfolios; and the role of active versus passive investment management. We also got some interesting insight on the life of an employee before and after the Lehman collapse, which is not an ordinary story for a student to hear.

Mr. Rogan spoke to us about current trends in hiring, the importance of casting a wide net for your first job, and highlighted the skills important to move up the ladder. Our professor Richard Ryffel also pointed out the importance of networking in a meaningful and impactful way instead of simply inviting people on LinkedIn.

Mr. Rogan spoke to us about current trends in hiring, the importance of casting a wide net for your first job, and highlighted the skills important to move up the ladder. Our professor Richard Ryffel also pointed out the importance of networking in a meaningful and impactful way instead of simply inviting people on LinkedIn.