Mike Crews, CFO, Peabody Energy, is also a 2004 alumnus of Olin’s Executive MBA (EMBA) program. He reflected on his time at Olin while speaking at the EMBA Leadership Perspective Series held at the Knight Center on March 31. He noted that he learned a great deal about self-awareness, managing people, working together, and especially thinking strategically while an EMBA student.

Crews comes from a family of CPAs – he’s the third generation in the accounting profession. He has risen through the ranks at Peabody from Senior Manager of Financial Reporting to Assistant Corporate Controller, Director of Planning, Assistant Treasurer, and Vice President of Operations Planning before he was promoted to Chief Financial Officer in June 2008. From the beginning, Crews found that there were people at Peabody who were interested in his development and that the company had opportunities for advancement and growth.

At one point in his career at Peabody, Crews saw a need to create a position of VP of Operations Planning and brought this idea to his superiors. They agreed and suggested he take the role, which he did. This was out of his area and comfort zone, and he expressed to the audience the need to be open to trying new things for your career to progress. He also spoke on the need to let people know what you want. Tell people if you want to advance or try a different role.

As Peabody’s CFO, he sees his top priority as execution of the company’s strategic plan. Crews observed that the CFO and CEO must be able to work side by side.

As a mentor, he said it is good to identify hard workers and give them further opportunity through stretch assignments. Of his mentors, he said, “mentors got more out of me than I ever thought.”

Information sessions, seminars, and other events are a great introduction to executive programs, and they provide an opportunity for you to meet Olin faculty, students, and alumni. Learn more.

Prof. Thakor draws on his research into the conditions and causes of the last two major financial crises to suggest that we may be heading in the same direction, again.

Prof. Thakor draws on his research into the conditions and causes of the last two major financial crises to suggest that we may be heading in the same direction, again.

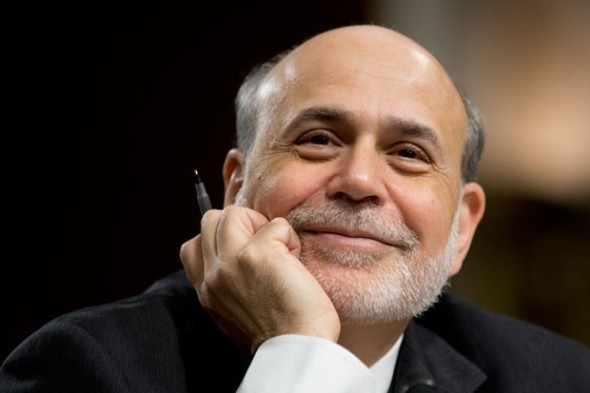

Bernanke launches his blog this week as a Distinguished Fellow in Residence with the Economic Studies Program at the Brookings Institution.

Bernanke launches his blog this week as a Distinguished Fellow in Residence with the Economic Studies Program at the Brookings Institution.

Hulbert writes, “The new indicator is based on the total amount of short selling in U.S. stocks. (Stock exchanges release information on short selling, which is a way that investors bet on a decline in prices.)

Hulbert writes, “The new indicator is based on the total amount of short selling in U.S. stocks. (Stock exchanges release information on short selling, which is a way that investors bet on a decline in prices.)