Interim Dean Anjan Thakor on Thursday announced the winners of the 2023 Olin Award: The authors of “Nip it in the Bud! Managing the Opioid Crisis: Supply Chain Response to Anomalous Buyer Behavior.”

The paper is by Seethu Seetharaman, the W. Patrick McGinnis Professor of Marketing and co-director of Center for Analytics and Business Insights (CABI); Michael Wall, professor of practice in marketing and entrepreneurship and co-director of CABI; Anthony Sardella, adjunct lecturer and senior research advisor at CABI; and Annie L. Shi, a doctoral student in marketing.

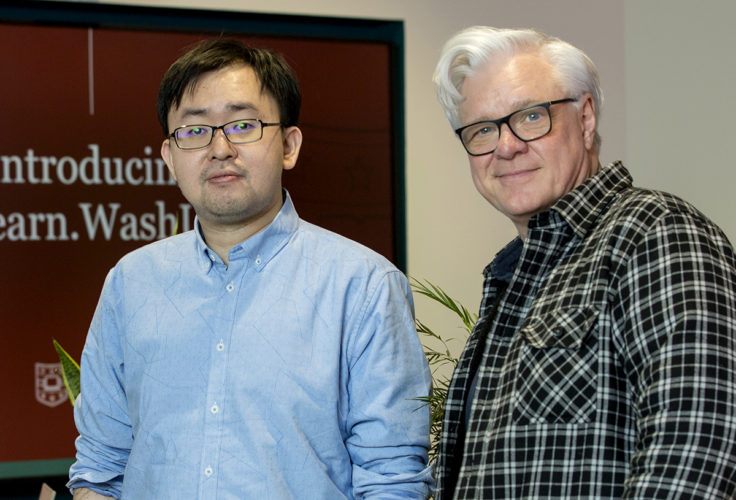

Seetharaman and Wall met with Thakor and Todd Milbourn, interim deputy dean and Hubert C. & Dorothy R. Moog Professor of Finance, in the dean’s suite Thursday morning and for the surprise announcement.

“I’ve got great news,” Thakor said. “Congratulations. You’re the winner of the 2023 Olin Award.”

The researchers developed a process for flagging suspicious transactions across 100 pharmaceuticals—a process with a stunningly high level of precision and one that can immediately take aim at curbing the country’s opioid epidemic.

Richard Mahoney, Olin distinguished executive in residence and former chairman and CEO of Monsanto, initiated the award, now in its 16th year, to promote scholarly research that has timely practical applications for complex management problems. He joined the meeting by Zoom.

“Let me add my congratulations,” Mahoney said. “I’ve been making these congratulations for a number of years, and this is a particular pleasure.”

“We’re delighted to hear this,” Seetharaman said. “And much appreciated, Dick. We’re deeply appreciative of the attention you’ve given our research.”

Their work comes under the auspices of the Olin Brookings Commission, a project by WashU Olin and the Brookings Institution to address critical policy issues affecting communities.

‘The potential to save lives’

“Your team’s work has quickly shown promise as a law enforcement tool to flag transactions that divert often legitimate prescription therapies toward illicit uses,” Thakor said.

“Your work, no doubt, has the potential to save lives.”

The winning paper will be presented at a virtual luncheon in April or May. The faculty authors will split a $25,000 award from Mahoney.

Of the 20 papers submitted, six went on to the second round, rated by corporate judges as research with potential impact to business, Thakor said.

Two tied for runner-up: “The Political Polarization of Corporate America,” by Margarita Tsoutsoura, associate professor of finance; and “Diversity Messages That Invite Allies in Diversity Efforts,” by Hannah Birnbaum, assistant professor of organizational behavior.