A year ago when Casey Lawlor and Dave Sutter won the Olin Award for a startup company that used new technology called “Blockchain” and the virtual currency “Bitcoin,” the two WashU class of 2014 alumni had a lot of explaining to do. Not many people had heard of blockchain, let alone understood it. Like all good entrepreneurs, they had started working with the technology in their dorm rooms and saw its potential to make smooth, virtual financial transactions across campus or across the world as the next big thing.

That’s why we featured Casey and Dave in the most recent issue of Olin Business Magazine, “Banking On Disruption“. We not only wanted to tell their story of launching one startup and how they pivoted to launch another one called Fluent, but through their story we wanted to understand and explain Blockchain and how it is disrupting the entire financial services industry.

That’s why we featured Casey and Dave in the most recent issue of Olin Business Magazine, “Banking On Disruption“. We not only wanted to tell their story of launching one startup and how they pivoted to launch another one called Fluent, but through their story we wanted to understand and explain Blockchain and how it is disrupting the entire financial services industry.

Today, it’s difficult to scan a business news site without seeing a story about Blockchain. Major banks are jumping on board and IBM announced a partnership with the Linux Foundation to further develop the technology. IBM also has a nice little video that explains how Blockchain works here.

Freelance writer Kurt Greenbaum and designers at our creative firm JagerBoston worked closely with Casey and Dave to craft the story and illustrations to explain Blockchain. Here’s an excerpt from the story, or link here to the full feature.

Watch Casey and Dave’s Elevator Pitch video here.

What is Blockchain?

To say the definition of blockchain is technical is an understatement. In simple terms, blockchain is software that maintains a continuously growing list of data records that are protected against tampering. This database is hosted on computers running the software. It’s essentially open-source software based on highly sophisticated mathematical algorithms that make transactions: 1. seamless, 2. virtually instantaneous, and 3. without the personal information required by credit card transactions.

In simple terms, blockchain is software that maintains a continuously growing list of data records that are protected against tampering.

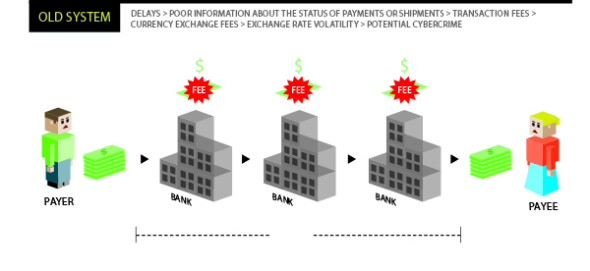

In essence, blockchain replaces conventional banking’s “trusted third parties” by creating a public ledger of all transactions that are continuously and publicly verified as safe. This eliminates the cost and delays of third-party verification typical in traditional banking transactions.

“Sending money around the world is going to drop in price,” explains John W. Ratcliff, a St. Louis software developer and member of the St. Louis Bitcoin Users Group. “It is about to become obscenely cheaper,” says Ratcliff, who has written extensively on the blockchain phenomenon.

Ratcliff calls services such as Western Union “dead men walking.” Such financial intermediaries, he says, will be increasingly irrelevant as blockchain technology grows.

From Dorm Room to Disruptive Technology

Dave Sutter and Casey Lawlor.

Dave Sutter and Casey Lawlor, AB ’14, first heard about blockchain software from WashU classmates who were dabbling in the nascent blockchain exchanges for the cryptocurrency bitcoin. They were intrigued. Never mind that Sutter was majoring in political science, and Lawlor was majoring in psychology with a minor in marketing. They steeped themselves in the world of bitcoin and blockchain. They learned all they could about the virtual currency, the complex mathematics behind it, and its potential to disrupt the existing banking system.

“Once we really got into it, it kind of consumed us,” said Sutter. “This entrepreneurial spirit was born in our college dorm room, and we went for it.”

The Bitcoin Society was Sutter and Lawlor’s first startup in 2013. They, along with a team of WashU students from Olin and other disciplines, were bent on aggregating and sharing news about the new technology—as well as providing consulting services to potential users.

Sutter and Lawlor eventually connected with a Lexington, Kentucky-based startup called “Love Will Inc.,” founded by software developers Lamar Wilson and Lafe Taylor. The developers had created a bitcoin “wallet” application necessary for anyone who wants to transact business with bitcoins. Sutter and Lawlor pitched a version of this bitcoin wallet in the Olin Cup competition, but eventually abandoned it for another one of Love Will Inc.’s products called “Fluent.”

Eliminate the Middleman

Unlike most other blockchain-powered applications, Sutter and Lawlor’s Fluent application allows users to transfer dollars, not virtual currency. According to Lawlor, business-to-business cross-border payments amount to $22 trillion a year globally. Those transactions come with delays, poor information about the status of payments, transaction fees, currency exchange fees, exchange rate volatility, and potential cybercrime.

By using Fluent, global businesses could bypass conventional banking and eliminate more than $1 trillion in annual transaction fees worldwide, according to the product’s pitchmen.

Fluent will charge customers a flat subscription fee, and currency exchange fees will be substantially lower than those charged by the traditional banking system. Lawlor and Sutter predict Fluent could generate $60 million in revenues within three years.

“A lot of banks are starting to hire talent in the blockchain space,” Lawlor said, acknowledging the race to apply the technology commercially. “It’s not if. It’s when. Obviously, we want to be the first to do it.”