For the second time in as many years, a WashU Olin team grabbed the first-place trophy at the prestigious Quinnipiac Global Asset Management Education Competition in New York City March 28-30, 2019.

A six-member team of master’s of finance students and BSBAs competed against 75 teams for the trophy in a competition culminating months of work managing a portion of the Washington University endowment fund, analyzing stock choices and presenting about the team’s investment strategy.

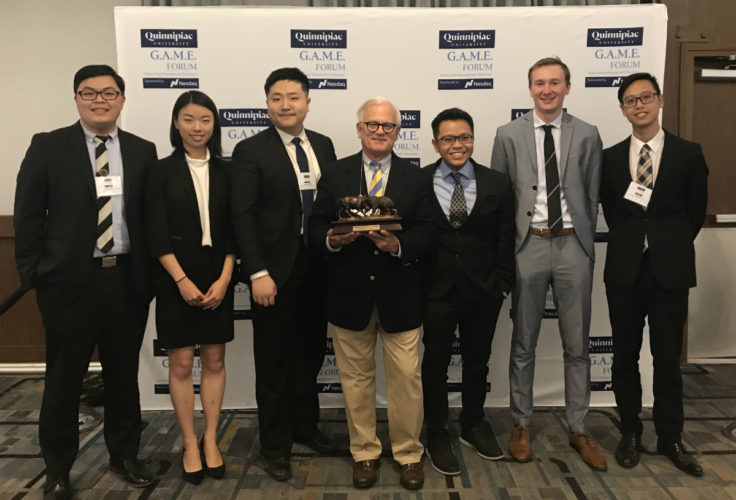

Olin Professor Tim Solberg coached the winning team, which included Tom Tian, BSBA ’20; Lilu Li, MSF-WAM ’19; Robert Huang, MSFC ’19; Alvin Nguyen, MSFC ’19; Carl Compton, BSBA ’19; and James Pai Hao-Lun, MSF ’19.

“Professor Solberg successfully put together a very diversified team,” said Nguyen, the team leader. “James has advanced technical skills, therefore he increased our team productivity by gathering necessary data from different sources, then cleaning them up, and uploading them to Bloomberg for analysis. Liyu’s quantitative background, Robert’s in-depth fundamental knowledge, and Tom’s quick thinking enabled us to combine all the resources needed to conduct our comprehensive analysis report quickly and efficiently.

“Carl transformed our analysis into an excellent PowerPoint presentation and collaborated with other team members to polish their presentation skills,” he added. “I leveraged the strengths of my teammates so we can work in complementary partnership to maximize each other’s strengths and compensate for individual weaknesses.”

An Olin team also won the same competition last year. In both cases, the students had participated in WashU’s “investment praxis” course, taught by senior lecturer Charles Cuny and Solberg. In the course, students manage a $1 million segment of Washington University’s endowment.

This year’s team didn’t have to fight through a wicked nor’easter to make it to the competition, but they shared the same appreciation for the discipline, teamwork and rigor required to compete.

“The competition gave me a much more holistic, hands on experience to the world of finance than is readily available at most schools,” Compton said. “The ability to run $1 million of real money puts much more emphasis on the psychological side of finance that escapes the normal classroom setting. It is very easy for students to nod their head in agreement when a company is worth buying or selling, but when the money is tangible, you begin to question your assumptions and selling policy.”

Using the new finance lab in the Kopolow Library, Solberg taught the team how to use Bloomberg terminals to determine portfolio attributions by industry sector and stock selection. It was while coaching the team last year he realized a financial lab would be much better for tutoring than having terminals spread throughout the campus.

Compton said the competition forced the team to do performance attribution and analyze a portfolio from multiple different angles, pushing them to better understand where their portfolio was underperforming or outperforming—and why.

“It’s easy to give a presentation on a portfolio that does better than the market, because no one questions you,” he said. “It is much more difficult to be convincing when your portfolio underperforms the market, and you have to argue that the portfolio performed exactly as it was expected to, even with huge drawdowns from unforeseeable losses from two holdings.”

He said the team felt confident standing in front of a panel of judges, delivering a robust answer to every question “and walking out of the room knowing you killed it.”

Pictured above: Tom Tian, BSBA ’20; Lilu Li, MSF-WAM ’19; Robert Huang, MSFC ’19; Tim Solberg; Alvin Nguyen, MSFC ’19; Carl Compton, BSBA ’19; James Pai Hao-Lun, MSF ’19.