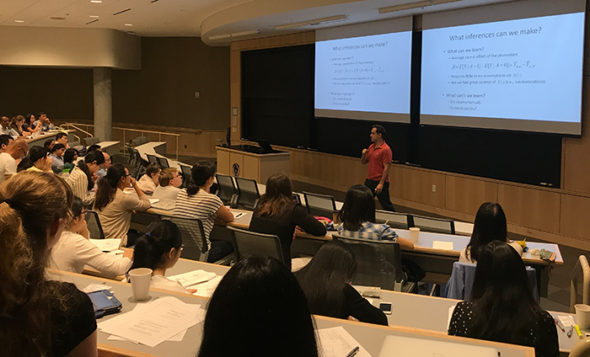

The Quantitative Marketing and Structural Econometrics Workshop hosted this month at Washington University attracted 153 PhD students and faculty from across the country who create complex models to dice and slice big data sets for research in the areas of marketing, economics, and operations.

The workshop’s goal is to prepare PhD students for the rigors of research in the academic job market, according to Olin’s Raphael Thomadsen, associate professor of marketing and co-organizer of the gathering.

“We saw many students going into the job market with supposed ‘structural’ papers which were not meaningfully structural at all,” said Thomadsen who created the workshop in 2010 with Brett Gordon, a professor at Kellogg School of Management.

“We saw many students going into the job market with supposed ‘structural’ papers which were not meaningfully structural at all,” said Thomadsen who created the workshop in 2010 with Brett Gordon, a professor at Kellogg School of Management.

“Rather, these papers had very complex models that were often not identified by the data. Further, many people ran structural models without understanding what benefits a structural model might bring.”

Zhenling Jiang, a PhD student at Olin, attended the workshop for a second time this July. She is preparing to go on the marketing job market in Summer 2018. According to Jiang, “It was hugely helpful for my PhD study. The workshop brings thought leaders in the field to share their experience and state-of-the-art techniques to students. Each topic is taught by someone who is highly experienced in the area.”

The workshop is intended for PhD students in marketing, economics, or related business disciplines who have completed at least two courses on microeconomics and econometrics. So, as you would imagine, I needed her help translating the subject for this post.

Basics of Structural and Non‐Structural Analysis

Thomadsen kicked off the workshop with the basics, as depicted in this chart:

Descriptive statistical analysis I understood, but models were new to me.

So I asked Jiang to explain: “Theory-based models draw on analysis of theories about how agents behave. The model could come from economic theory or psychology theory. For example, consumers maximize their utility or firms maximize profit. The structural model describes how agents make decisions, and this results in the observational data being generated from agents behaving according to the model (i.e. the data generating process).

“By getting the ‘primitives of the model,’ effectively we know how agents will behave. The powerful thing about structural models is that you can simulate what agents’ behavior will be like under a different situation (counterfactual analysis) that is not observed in data.”

Her explanation was helpful, but still a little beyond my comprehension. Another presentation takeaway was reassuring, “Structural need not be complex, and complexity does not mean structural.” But then came the next presentation.

Model-Free Evidence and Structural Models

Professor Brett Gordon led the students through a marketing problem about a digital advertising campaign for an online retailer. How did exposing consumers to an online ad (with a $10 discount code) affect sales? He explained that descriptive analysis—model-free evidence—should motivate a structural model.

Then, by applying a structural model to the observational data, one can make predictions beyond the observed data. For example, what would sales be if free shipping were offered?

Answering questions like this is why we need PhDs in marketing.

Answering questions like this is why we need PhDs in marketing.

According to Thomadsen, the workshop has two types of sessions: philosophical and technique. “For the philosophical sessions, we want students to understand that when one estimates a structural model (or any model, really), one needs to think about the data generating process behind it. If one cannot identify what variation in the data links the data to the parameter estimates, then one needs to either get better data or use a different model.

According to Thomadsen, the workshop has two types of sessions: philosophical and technique. “For the philosophical sessions, we want students to understand that when one estimates a structural model (or any model, really), one needs to think about the data generating process behind it. If one cannot identify what variation in the data links the data to the parameter estimates, then one needs to either get better data or use a different model.

“For the technique sessions, we discuss how to estimate demand, how to solve models with dynamics (where the choices you make today affect the tradeoffs you face tomorrow), estimate game theory models (where the choices one person/firm makes affects the payoffs of another person/firm, and vice versa), and new machine learning techniques.”

Note: The Quantitative Marketing and Structural Econometrics Workshop was hosted at Washington University on July 17-19, 2017. Previously, Thomadsen co-organized this workshop with Brett Gordon of Kellogg, and Rick Staelin of Duke University. The workshop was held at Duke’s executive center in 2010 and 2013 and at Kellogg’s Allen Center in 2015. Attendance has ranged roughly from 95 – 130 students and faculty in the past years, not including the organizers and presenters.